Financial stability is a dream for many, but deciphering the jargon-laden world of finance can make it seem elusive. Studies reveal that only 34% of Americans could pass a basic financial literacy test! This blog post breaks down the complex concept of financial literacy into digestible chunks to help you take control of your personal finances and build a secure future.

Ready to embark on your journey towards financial enlightenment?.

What is Financial Literacy?

Financial literacy refers to the knowledge and understanding of various financial concepts and skills that enable individuals to make informed decisions about their personal finances, investments, and overall financial management.

Definition

Financial literacy means you know how to handle your money. It’s knowing how to make a budget, pay bills on time, and save for the future. You also understand credit, loans, and interest rates.

This skill helps you make good choices about money. If you are financially literate, you can have more control over your life and feel less stressed about money.

Importance

Financial literacy is essential for women to build a secure future. It empowers individuals to make informed decisions about their personal finances, investments, and financial management.

By having the knowledge and skills needed for financial planning, women can create a road map for their money and achieve their financial goals. Being financially literate also plays a crucial role in maintaining good credit, understanding money management, and making wise investment choices.

With this knowledge, women can take control of their financial well-being and ensure economic stability throughout their lives.

How to Build a Secure Future through Financial Literacy

Building a secure future through financial literacy involves taking steps for financial security, tailoring financial literacy to specific demographics, and utilizing useful resources for education and guidance.

Steps for Financial Security

To build a secure future through financial literacy, there are important steps you can take. First, create a budget to track your income and expenses. This will help you see where your money is going and make adjustments as needed.

Second, save for emergencies by setting aside a portion of each paycheck into a separate savings account. This will provide a safety net for unexpected expenses. Third, pay off high-interest debts like credit cards as quickly as possible to avoid paying unnecessary interest charges.

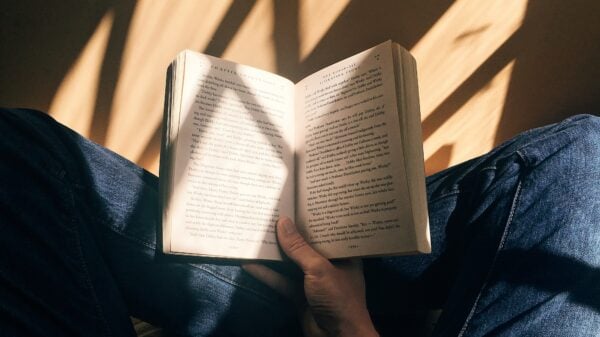

Fourth, invest in your future by contributing to retirement accounts such as an employer-sponsored 401(k) or an individual retirement account (IRA). Finally, educate yourself about personal finance by reading books or blogs on the topic and attending workshops or seminars.

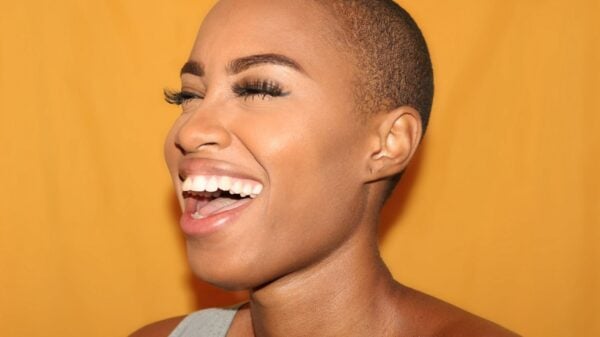

Financial Literacy for Specific Demographics

Financial literacy is important for everyone, including specific demographics such as women aged 25 and above. By empowering themselves with financial knowledge, these individuals can make informed decisions about their personal finances and work towards achieving their financial goals.

Whether it’s learning about good credit maintenance, understanding the basics of investing, or creating a budget for effective money management, financial proficiency provides a road map for building a secure future.

There are many online resources available that cater specifically to women and provide valuable information on topics like wealth management, investment planning, retirement savings, budgeting, credit management, and more.

Useful Resources for Financial Literacy

When it comes to building a secure future through financial education, there are many useful resources available. One such resource is online platforms that provide financial education and tools for managing personal finances.

These websites offer information on topics like budgeting, investing, and retirement savings. Another valuable resource is bank branches, where you can speak with financial advisors who can help create a road map for your money.

They can assist in setting financial goals, managing debt, and planning for the future. By utilizing these resources and empowering yourself with knowledge about personal finance, you can make informed decisions that will contribute to your long-term financial wellbeing.